Demand for folding cartons is expected to grow 3.9% per year through 2022 to $12.8 billion. In 2018, the Trump administration levied a 10% tariff on folding cartons from China that was scheduled to increase to 25% on January 1, 2019; however, in December 2018, China and the U.S. agreed on a temporary suspension of tariff increases. If tariffs continue to rise as planned, they will result in increases in domestic production as well as a more rapid transition to flexible packaging formats. These and other trends are presented in Corrugated & Paperboard Boxes, a new study from The Freedonia Group, an industry research firm.

The U.S. maintains a trade deficit in folding cartons that accounted for about 5% of demand in 2017. By value, Canada supplies almost half of the folding cartons imported to the U.S. due to its geographic proximity and abundant forestry resources and processing facilities. China is the second largest source of folding cartons — in both volume and value terms — because the country’s low manufacturing costs offset the cost of shipping these products.

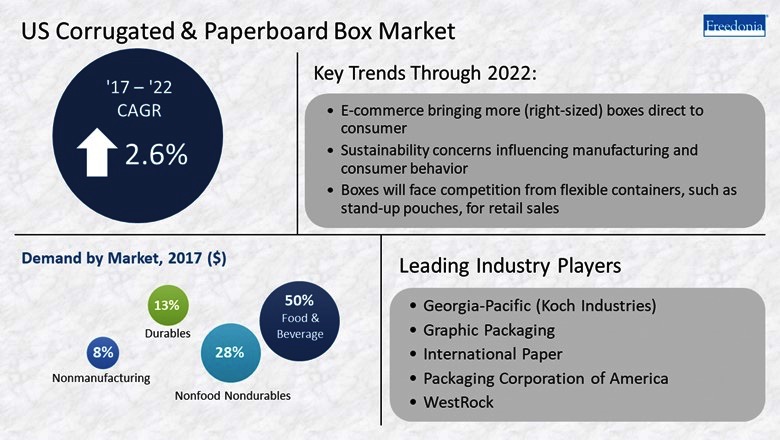

Demand for all types of corrugated and paperboard boxes (i.e., corrugated and solid fiber, folding cartons and setup boxes) is forecast to increase 2.6% annually to $42.5 billion in 2022. Nearly half of all new demand will stem from the food and beverage market, and 16% of new box sales will derive from the rapidly growing e-commerce segment.

Corrugated & Paperboard Boxes (published 01/2019, 212 pages)is available for $5500 from The Freedonia Group: https://www.freedoniagroup.com/Corrugated-Paperboard-Boxes.html