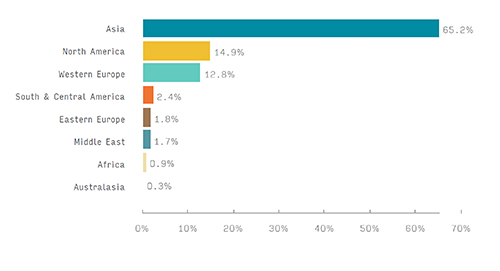

Sustainability demands will push further growth in sales of cartonboard, microflute and miniflute packaging, according to the latest data from Smithers. In 2023, actual consumption of these paperboard formats will reach a projected 56.8 million tons worldwide, up from 47.8 million tons in 2019.

Exclusive forecasting available to purchase now from Smithers, in its latest market report – The Future of Folding Cartons to 2028 – shows this will reach 77.3 million tons in 2028, equivalent to a compound annual growth rate (CAGR) of +6.4%.

Across the same period value of cartonboard will increase from $60.4bn to $79.7bn (at constant prices), equivalent to a CAGR of +5.7%. The global value of converted folding carton packaging will reach $199.0bn in 2023; and then increase to $274.5bn in 2028.

New Growth

Analysis of the 24 end-use applications included in Smithers’ extensive data set, reveals folding carton use will remain fairly evenly split between food and beverage, and other applications. Much new growth is coming from evolving existing paper technologies to replace plastics, supported by legislation, such as the forthcoming revision of the Packaging and Packaging Waste Directive in Europe. This includes new formats in fresh produce, food service, beverage multipacks, ready meals, home, and personal care.

The fastest growing sectors across the next five years will be dry foods, confectionary, healthcare, personal care, and chilled food. Acceptance in several of these is conditional on deploying improved coating technology to protect fibres from wet or fatty foods, and present a premium print surface. Smithers estimates that nearly 70% of all cartonboard packaging carries a coating of some form. In 2023 90% of these coatings by weight are thermoplastic polymers or aluminum, and there is a premium to develop for functional coatings that do not compromise fibre recyclability. Paper mills are taking steps to upgrade machines to enable or improve inline coating on the paper machine to meet the growing demand for these types of coated cartonboard.

Premium Packaging

Luxury packaging remains a major target for many suppliers, with new premium grades entering the market combining superior print surfaces, with greater recyclability credentials. This is stimulating greater demand for virgin pulp cartonboard. Simultaneously there is an impetus to add smart tracking technology to folding cartons giving greater supply chain insight and protecting high-value goods against counterfeiting.

Price Disruption

The market is also having to negotiate price disruption. Raw material prices rose by over 25% in 2022 following a 14% increase in 2021. In the short-term this is creating a febrile marketplace, even as new folding carton assets come online. A total of over six million tons of production capacity entered the market between 2020 and 2022, which gives a global installed capacity in 2022 of over 59 million tons, providing a buffer of some five million tons.

Paper mills, especially in Europe, are increasingly investing in more energy-efficient equipment and even trialing alternative pulp supplies. This is reflected in an increased consumption of uncoated recycled board (URB); although coated recycled board (CRB)/white-lined chipboard (WLC) and folding boxboard (FBB) will continue to represent the majority of the market.

Booming demand for dedicated e-commerce formats has translated into an acceleration of demand for microflute packaging, featuring a litho-laminated outer layer of cartonboard applied to the single-face corrugated under-layers. Over time it is anticipated that some of this cartonboard market will be eroded by the use of linerboard, thereby removing the need for a separate lamination process.

The Future of Folding Cartons to 2028 dissects the current and future market for this packaging type in forensic detail. Its exclusive data (by volume and value) is presented in over 350 tables and figures, segmenting the market by eight board grades and formats; 24 end-use applications, and 31 leading national and regional markets.